Categories

Categories

- Home

- General

- General 1950-present

- Pittsburgh Plate Glass Company 1960's (Pennsylvania)

Pittsburgh Plate Glass Company 1960's (Pennsylvania)

Product Description

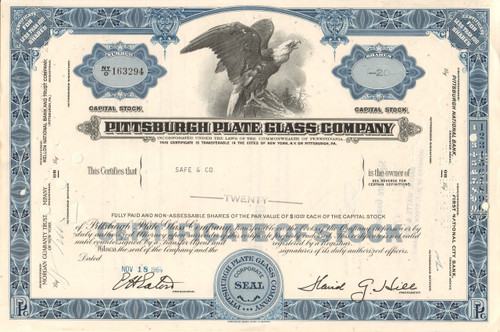

Pittsburgh Plate Glass Company stock certificate 1960's (Pennsylvania)

Great corporate name. Very nice vignette of an American eagle with wings spread perched on a rock with trees in the background. Issued and cancelled. Dated in the 1960's.

Pittsburgh Plate Glass Company was founded in 1883 by Captain John Baptiste Ford and John Pitcairn, Jr., at Creighton, Pennsylvania. Based in Creighton PA, PPG soon became the United States' first commercially successful producer of high-quality, thick flat glass using the plate process. PPG was also the world's first plate glass plant to power its furnaces with locally-produced natural gas, an innovation which rapidly stimulated widespread industrial use of the cleaner-burning fuel.

PPG expanded quickly. By 1900, known as the "Glass Trust", it included 10 plants, had a 65 percent share of the U.S. plate glass market, and had become the nation's second largest producer of paint. Today, known as PPG Industries, the company is a multi-billion dollar, Fortune 500 corporation with 150 manufacturing locations around the world. It now produces coatings, glass, fiberglass, and chemicals.

On 19 December 1968 the company changed its name to PPG Industries, Inc., to show its diverse offerings. Ditzler Color Company, established in 1902 in Detroit as an automotive color concern, was purchased by Pittsburgh Plate Glass Company (now PPG) in 1928. In the mid-1980s, Cipisa, a Spanish paint company was acquired and renamed PPG Ibérica. The CEO of Cipisa, Pere Nadal Carres became CEO of PPG Ibérica. In 1990 PPG founded Transitions Optical as a joint venture with Essilor.

In 2007, the company was involved in a lawsuit on failing to disclose a purchase reduction of its two major auto glass customers. On 2 January 2008, PPG acquired the SigmaKalon Group of companies for $3.2 billion from private investment firm Bain Capital, strongly increasing its paint and specialty coatings business. In April 2013, PPG completed the acquisition of AkzoNobel North American architectural coatings business including Glidden, Liquid Nails, and Flood brands.

On April 1, 2014, PPG finalized the sale of Transitions Optical to its joint venture partner, Essilor International of France, however, PPG’s technical center in Monroeville will continue to provide research and development services for Transitions. On November 5, 2014 PPG closed a deal, to purchase Mexican Consorcio Comex, S.A. de C.V. (“Comex”) for $2.3 billion. In April 2015, PPG Industries completed the acquisition of REVOCOAT, a global supplier of sealants. Chuck Bunch remains Executive Chairman, while Michael McGarry serves as President & CEO.

Loading... Please wait...

Loading... Please wait...