Categories

Categories

- Home

- Food and Beverage

- Food Brands

- RJR Nabisco Holdings Group, Inc. bond 1990 (huge leveraged buyout)

RJR Nabisco Holdings Group, Inc. bond 1990 (huge leveraged buyout)

Product Description

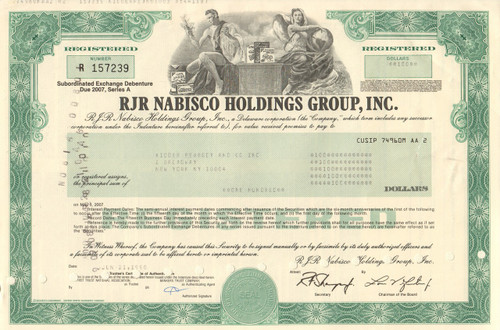

RJR Nabisco Holdings Group, Inc. bond certificate 1990 (huge leveraged buyout)

Awesome tobacco-food company piece. Nice vignette of classical seated figures flanking Nabisco products with a tobacco field at the lower right. Registered bond. Issued and cancelled. Dated early 1990 just after the company name was changed.

RJR Nabisco, Inc., was an American conglomerate, selling tobacco and food products, headquartered in the Calyon Building in Midtown Manhattan, New York City. RJR Nabisco stopped operating as a single entity in 1999; however, both RJR (as R.J. Reynolds Tobacco) and Nabisco (now part of Mondelēz) still exist.

RJR Nabisco was formed in 1985 by the merger of Nabisco Brands and R.J. Reynolds Tobacco Company. In 1988 RJR Nabisco was purchased by Kohlberg Kravis Roberts & Co. in what was at the time the largest leveraged buyout in history. In 1999, due to concerns about tobacco lawsuit liabilities, the tobacco business was spun off into a separate company, and RJR Nabisco was renamed Nabisco Holdings Corporation. Nabisco is currently owned by Mondelēz International Inc.

RJR Nabisco Holdings Corp. was the parent company of RJR Nabisco, Inc. After the food and tobacco businesses separated in June 1999, Nabisco Group Holdings Corp. owned 80% of RJR Nabisco Holdings Corp., which was the parent company of Nabisco, Inc. R. J. Reynolds Tobacco Company was founded in Winston-Salem, North Carolina in 1875 and changed its name to R. J. Reynolds Industries, Inc. in 1970. It became RJR Nabisco on April 25, 1986 after the company's $4.9 billion purchase of Nabisco Brands Inc. in 1985.

The RJR Nabisco leveraged buyout was, at the time, widely considered to be the pre-emininent example of corporate and executive greed. Bryan Burrough and John Helyar published Barbarians at the Gate: The Fall of RJR Nabisco, a successful book about the events which was later turned into a television movie for HBO. The leveraged buyout was in the amount of $25 billion, and the battle for control took place between October and November 1988.

Although KKR eventually took control of RJR Nabisco, RJR management and Shearson Lehman Hutton had originally announced that they would take RJR Nabisco private at $75 per share. A fierce series of negotiations and proposals ensued which involved nearly all of the major private equity players of the day, including Morgan Stanley, Goldman Sachs, Salomon Brothers, First Boston, Wasserstein Perella & Co., Forstmann Little, Shearson Lehman Hutton, and Merrill Lynch. Once put in play by Shearson Lehman Hutton and RJR management, almost every major Wall Street firm involved in M&A launched frenzied, literal last-minute bids in a fog of incomplete or misleading information.

KKR quickly introduced a tender offer to obtain RJR Nabisco for $90 per share—a price that enabled it to proceed without the approval of RJR Nabisco's management. RJR's management team, working with Shearson Lehman Hutton and Salomon Brothers, submitted a bid of $112, a figure they felt certain would enable it to outflank any response by Kravis. KKR's final bid of $109, while a lower dollar figure, was ultimately accepted by the board of directors. It was accepted because KKR's offer was guaranteed whereas management's lacked a "reset". Additionally, many in RJR's board of directors had grown concerned at recent disclosures of Johnson's unprecedented golden parachute deal. Time Magazine featured Johnson with the headline "A Game of Greed: This man could pocket $100 million from the largest corporate takeover in history. Has the buyout craze gone too far?".

On March 21, 1991, RJR Nabisco Holdings Corp. became a publicly traded stock. In March 1999, RJR Nabisco announced the sale of the international division of R. J. Reynolds Tobacco, and in June of that year, the company sold the remainder of R. J. Reynolds Tobacco to stockholders. The parent company became Nabisco Group Holdings and owned 80.5 percent of Nabisco Holdings. In 2000, Philip Morris bought Nabisco Holdings. Soon after that, R. J. Reynolds Tobacco Holdings, Inc., first traded in June 1999, announced the acquisition of Nabisco Group Holdings. The deal was completed in December 2000.

Loading... Please wait...

Loading... Please wait...