Categories

Categories

- Home

- Banking and Money

- Banks

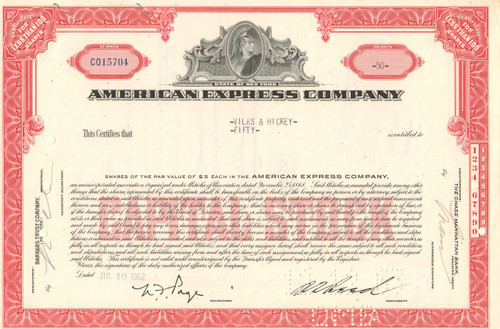

- American Express Company 1962

American Express Company 1962

Product Description

American Express Company stock certificate 1962

Uncommon piece with a great vignette of the company logo, a roman centurion.Issued and cancelled, dated 1962.

The American Express Company, also known as Amex, is an American multinational financial services corporation headquartered in Manhattan's Three World Financial Center in New York City, United States. Founded in 1850, it is one of the 30 components of the Dow Jones Industrial Average. The company is best known for its credit card, charge card, and traveler's cheque businesses. Amex cards account for approximately 24% of the total dollar volume of credit card transactions in the US.

BusinessWeek ranked American Express as the 22nd most valuable brand in the world, estimating the brand to be worth US$14.97 billion. Fortune listed Amex as one of the top 20 Most Admired Companies in the World. The company's logo, adopted in 1958, is a Centurion whose image appears on the company's travelers' cheques, stock certificates, and credit cards.

In 1850, American Express was started as an express mail business in Buffalo, New York. It was founded as a joint stock corporation by the merger of the express companies owned by Henry Wells (Wells & Company), William G. Fargo (Livingston, Fargo & Company), and John Warren Butterfield (Wells, Butterfield & Company, the successor earlier in 1850 of Butterfield, Wasson & Company). Wells and Fargo also started Wells Fargo & Co. in 1852 when Butterfield and other directors objected to the proposal that American Express extend its operations to California.

American Express initially established its headquarters in a building at the intersection of Jay Street and Hudson Street in what was later called the Tribeca section of Manhattan. For years it enjoyed a virtual monopoly on the movement of express shipments throughout New York State. In 1874, American Express moved its headquarters to 65 Broadway in what was becoming the Financial District of Manhattan, a location it was to retain through two buildings.

In 1854, the American Express Co. purchased a lot on Vesey Street in New York City as the site for its stables. The company's first New York headquarters was an 1858 marble Italianate palazzo at 55–61 Hudson Street, which had a busy freight depot on the ground story with a spur line from the Hudson River Railroad. A stable was constructed in 1867, five blocks north at 4–8 Hubert Street.

The company prospered sufficiently that headquarters were moved in 1874 from the wholesale shipping district to the budding Financial District, and into rented offices in two five-story brownstone commercial buildings at 63 and 65 Broadway that were owned by the Harmony family. By 1903, the company had assets of some $28 million, second only to the National City Bank of New York among financial institutions in the city. To reflect this, the company purchased the Broadway buildings and site.

American Express extended its reach nationwide by arranging affiliations with other express companies (including Wells Fargo – the replacement for the two former companies that merged to form American Express), railroads, and steamship companies. In 1882, American Express started its expansion in the area of financial services by launching a money order business to compete with the United States Post Office's money orders. Sometime between 1888 and 1890, J. C. Fargo took a trip to Europe and returned frustrated and infuriated. Despite the fact that he was president of American Express and that he carried with him traditional letters of credit, he found it difficult to obtain cash anywhere except in major cities. Fargo went to Marcellus Flemming Berry and asked him to create a better solution than the traditional letter of credit. Berry introduced the American Express Traveler's Cheque which was launched in 1891 in denominations of $10, $20, $50, and $100.

American Express became one of the monopolies that President Theodore Roosevelt had the Interstate Commerce Commission (ICC) investigate during his administration. The interest of the ICC was drawn to its strict control of the railroad express business. During the winter of 1917, the United States suffered a severe coal shortage and on December 26 President Woodrow Wilson commandeered the railroads on behalf of the United States government to move federal troops, their supplies, and coal. This ended American Express's express business, and removed them from the ICC’s interest.

During the 1980s, American Express embarked on an effort to become a financial services super-company and made a number of acquisitions to create an investment banking arm. In mid-1981 it purchased Sanford I. Weill's Shearson Loeb Rhoades, the second largest securities firm in the United States to form Shearson/American Express.

After the purchase of Shearson, Weill was given the position of president of American Express in 1983. In 1984, American Express acquired the investment banking and trading firm, Lehman Brothers Kuhn Loeb, and added it to the Shearson family, creating Shearson Lehman/American Express. In 1984, Shearson/American Express purchased the 90-year-old Investors Diversified Services, bringing with it a fleet of financial advisors and investment products. In 1988, Shearson Lehman acquired E.F. Hutton & Co., a brokerage firm founded in 1904, this was merged with the investment banking business and the investment banking arm was renamed Shearson Lehman Hutton, Inc.

In 1993, American Express decided to get out of the investment banking business and negotiated the sale of Shearson's retail brokerage and asset management business to Primerica. The Shearson business was merged with Primerica's Smith Barney to create Smith Barney Shearson. Ultimately, the Shearson name was dropped in 1994. In 1994, American Express spun off of the remaining investment banking and institutional businesses as Lehman Brothers Holdings Inc which after almost fifteen years of independence would file for bankruptcy protection in 2008 as part of the late–2000s financial crisis.

American Express executives discussed the possibility of launching a travel charge card as early as 1946, but it was not until Diners Club launched their card in March 1950 that American Express began seriously to consider the possibility. At the end of 1957, American Express CEO Ralph Reed decided to get into the card business, and by the launch date of October 1, 1958 public interest had become so significant that they issued 250,000 cards prior to the official launch date. In 1966, American Express introduced the Gold Card and in 1984 the Platinum Card, clearly defining different market segments within its own business, a practice that has proliferated across a broad array of industries.

Loading... Please wait...

Loading... Please wait...