Categories

Categories

- Home

- Railroad

- Modern Railroads

- Pennsylvania New York Transportation Company 1960's

Pennsylvania New York Transportation Company 1960's

Product Description

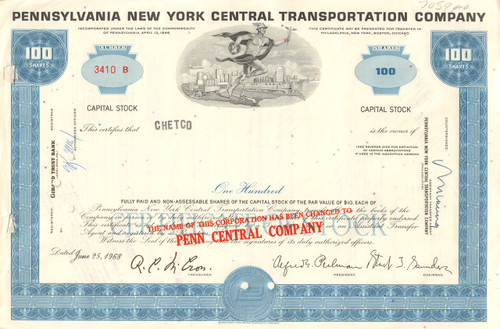

Pennsylvainia New York Central Transportation Company stock certificate 1960's

Affordable railroad piece with a neat vignette of Mercury in front of scenes of various modes of transportation against a city skyline. Dated right after the famous merger. Issued and cancelled. Dated in the 1960's. Available in blue, brown, or set of 2 colors.

The Penn Central Transportation Company, commonly abbreviated to Penn Central, was an American Class I railroad headquartered in Philadelphia, Pennsylvania, that operated from 1968 until 1976. It was created by the 1968 merger of the Pennsylvania and New York Central railroads. The New York, New Haven & Hartford Railroad was added to the merger in 1969; by 1970, the company had filed for what was, at that time, the largest bankruptcy in U.S. history.

The Penn Central was created as a response to challenges faced by all three railroads in the late 1960s. The Northeast United States is the most densely populated region of the U.S. While railroads elsewhere in North America drew a sizable percentage of revenues from the long-distance shipment of commodities such as coal, lumber, paper and iron ore, northeastern railroads traditionally depended on a more heterogeneous mix of services. These labor-intensive, short-haul services were vulnerable to competition from automobiles, buses, and trucks, particularly where facilitated by four-lane highways. In 1956, the U.S. Congress passed the Federal-Aid Highway Act of 1956. This law authorized construction of the Interstate Highway System, which provided an economic boost to the trucking industry.

At the time, U.S. railroads were overregulated by the Interstate Commerce Commission (ICC), which did not allow railroads to change rates it charged both shippers and passengers. Reducing costs was the only way to survive and become profitable, but the ICC restricted what cost-cutting could take place. A merger seemed to be a promising way out of a difficult situation.

The Pennsylvania Railroad (PRR) and New York Central Railroad (NYC) had been significant rivals for some time. Both railroads had physical plant not being utilized to capacity (NYC was in better shape); both had a heavy passenger business; neither was earning much money. Talks of a merger had been announced as early as 1957.

Planning and justifying the merger took nearly a decade, during which time the eastern railroad scene changed dramatically, in large measure because of the impending merger of the NYC and PRR. The Erie merged with the DL&W to create the Erie Lackawanna Railway (EL) in 1960, the Chesapeake & Ohio Railway (C&O) acquired control of the B&O, and the N&W took in several railroads, including the Nickel Plate and Wabash.

Penn Central (PC) came into existence on February 1, 1968. On that date, the PRR — the nominal survivor of the merger — changed its name to Pennsylvania New York Central Transportation Company. It adopted the name Penn Central Company on May 8, 1968. On October 1, 1969, it again changed its name, to Penn Central Transportation Company, and became a wholly owned subsidiary of a new Penn Central Company, a holding company.

PC's holding company tried to diversify the troubled firm into real estate and other non-railroad ventures, but in a slow economy these businesses performed little better than the railroad assets. In addition, these new subsidiaries diverted management attention away from the problems in the core business. Management also insisted on paying dividends to shareholders to create the illusion of success. The company had to borrow additional funds to maintain operations. Interest on loans had become an unbearable financial burden.

PRR and NYC came into the merger in the black, but PC's first year of operation yielded a deficit of $2.8 million. In 1969 the deficit was nearly $83 million. PC's net income for 1970 was a deficit of $325.8 million. By then the railroad had entered bankruptcy proceedings — specifically on June 21, 1970. The nation's sixth largest corporation had become its largest bankruptcy (the Enron Corporation's 2001 bankruptcy eclipsed this in large measure). Although the PC was put into bankruptcy, its parent Penn Central Company was able to survive. The devastating effects of Hurricane Agnes in 1972 further hampered PC operations, destroying many important branches and main lines.

The reorganization court decided in May 1974 that PC was not re-organizable on the basis of income. A U.S. government corporation, the United States Railway Association, was formed under the provisions of the Regional Rail Reorganization Act of 1973 to develop a plan to save PC. The outcome was that Consolidated Rail Corporation (Conrail), owned by the U.S. government, took over railroad properties and operations of PC (and six other railroads: EL, LV, RDG, Lehigh & Hudson River Railway, Central Railroad of New Jersey, and Pennsylvania-Reading Seashore Lines) on April 1, 1976.

It was a major step toward nationalization of the railroads in the U.S. They had been nationalized briefly during World War I, but the U.S. had held out against a world-wide trend toward nationalization of railroads until the creation of Amtrak which nationalized the country's passenger trains, on May 1, 1971. Amtrak initially operated a skeleton passenger service on PC track as well as other U.S. railroads.

Facing continued loss of market share to the trucking industry, the railroad industry and its unions asked the federal government for deregulation. The 1980 Staggers Act, which deregulated the railroad industry, proved to be a key factor in bringing Conrail and the old PC assets back to life. During the 1980s, the deregulated Conrail had the muscle to implement the route reorganization and productivity improvements that the PC had unsuccessfully tried to implement during 1968 to 1970. The stock of the subsequently-profitable Conrail was refloated on Wall Street in 1987, and the company operated as an independent, private-sector railroad from 1987 to 1999.

Loading... Please wait...

Loading... Please wait...