Categories

Categories

- Home

- General

- General 1950-present

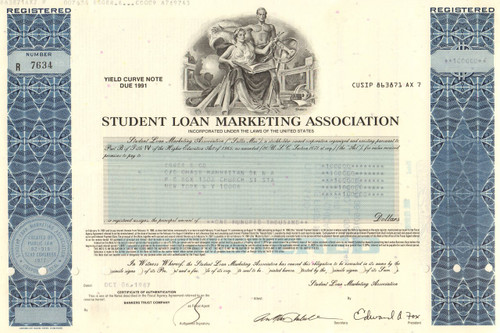

- Student Loan Marketing Association bond - 1980's (Sallie Mae)

Student Loan Marketing Association bond - 1980's (Sallie Mae)

Product Description

Student Loan Marketing Association bond certificate - 1980's

Unusual piece with a nice vignette of two classical figures with books, a globe, and other educational symbols. Issued and cancelled. Dated in the 1980's.

SLM Corporation (commonly known as Sallie Mae; originally the Student Loan Marketing Association) is a publicly traded U.S. corporation that at present (2015) provides consumer banking. Its nature has changed dramatically since it was set up in 1973. At first, it was a government entity that serviced federal educational loans. It then became private and started offering private student loans, although at one point it had a contract to service federal loans.

The company's primary business is originating, servicing, and collecting private education loans. The company also provides college savings tools such as its Upromise Rewards business and online planning for college tools and resources. Sallie Mae was previously originated federally guaranteed student loans originated under the Federal Family Education Loan Program (FFELP). and also worked as a servicer and collector of federal student loans on behalf of the Department of Education. The company now offers private education loans and manages more than $12.97 billion in assets. Sallie Mae employs 1,400 individuals at offices across the U.S.

On April 30, 2014, Sallie Mae spun off its loan servicing operation and most of its loan portfolio into a separate, publicly traded entity called Navient Corporation. Navient is the largest servicer of federal student loans and also acts as a collector on behalf of the Department of Education.

On April 16, 2007, Sallie Mae announced that an investor group led by J.C. Flowers & Co. signed an agreement to purchase Sallie Mae for approximately $25 billion. The deal fell through in September 2007, with the buyers blaming adverse changes to the business's outlook as a result of the College Cost Reduction and Access Act of 2007 and the tightening of global credit markets following the 2007 subprime mortgage financial crisis. Sallie Mae subsequently began legal action, only to drop it in January 2008 upon completion of a $31 billion funding round, including funding from Bank of America.

The Student Loan Marketing Association was originally created in 1972 as a government-sponsored enterprise (GSE) and began privatizing its operations in 1997, a process it completed at the end of 2004 when Congress terminated its federal charter, ending its ties to the government.

1973: The Student Loan Marketing Association (nicknamed “Sallie Mae”) opens its doors as a Government-Sponsored Enterprise (GSE). It is designed to support the guaranteed student loan program created by the Higher Education Act of 1965.

1975: First shareholder meeting is held. First loan is purchased from 1st Pennsylvania Bank.

1978: Board authorizes in-house loan servicing operations.

1979: Total assets exceed $1 billion.

1984: Sallie Mae shares publicly traded on the New York Stock Exchange under ticker symbol SLM.

1992: Sallie Mae creates The Sallie Mae Fund. Over the next two decades, the Fund will contribute more than $125 million to increase access to higher education and to support local communities.

1994: William D. Ford Direct Student Loan Program enacted into law. Clinton Administration announces that Sallie Mae should restructure itself from a GSE to a private company.

1997: Shareholders approve privatization of Sallie Mae.

2004: Sallie Mae is fully privatized, four years ahead of schedule.

2006: Sallie Mae becomes the nation's leading saving-for-college company with the acquisition of Upromise® and Upromise Investments®.

2008: Sallie Mae is selected to service federal loans on behalf of the U.S. Department of Education.

2009: The Smart Option Student Loan® —a private education loan—is introduced, an innovative loan that provides life-of-loan savings with in-school interest payments.

On April 6, 2009, Sallie Mae announced that it will move 2,000 jobs back to the U.S. within the next 18 months as it shifts call center and other operations from overseas.

2010: Congress passes the Health Care and Education Reconciliation Act of 2010, which eliminates the public-private partnership Federal Family Education Loan Program (FFELP). Effective July 1, 2010, all federal loans are originated directly by the U.S. Department of Education.

On March 31, 2010, Sallie Mae announced the impending layoff of 2,500 employees in response to the signing of new legislation calling for the federal government to lend directly to students, bypassing institutions like Sallie Mae.

On July 1, 2010, Sallie Mae announced that it will be moving its headquarters from Reston, Virginia, to its existing facility in Newark, Delaware, in 2011.

On September 17, 2010, it was announced that Sallie Mae will acquire federally insured loans from Citigroup-owned Student Loan Corporation worth $28 billion.

2011: Sallie Mae expands its saving, planning, and paying for college financial services initiatives with retail banking products: high-yield savings accounts, CDs, and checking accounts through Sallie Mae Bank® and credit cards with rewards to help pay down education loans.

2012: Sallie Mae expands its private education loan options by introducing a new fixed interest rate version of the Smart Option Student Loan.

2014: Sallie Mae split into two, publicly traded entities: a consumer banking business and a newly named loan management, servicing and asset recovery business, Navient Corporation.

Loading... Please wait...

Loading... Please wait...