Categories

Categories

- Home

- General

- General 1900-1950

- Bethlehem Steel Corporation 1927 (famous bankruptcy)

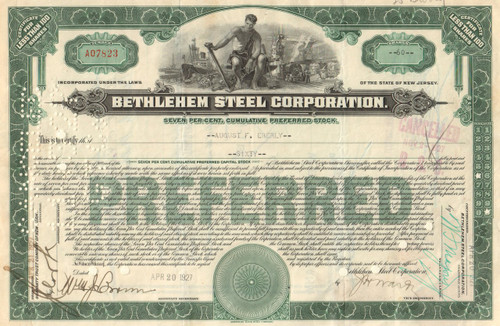

Bethlehem Steel Corporation 1927 (famous bankruptcy)

Product Description

Bethlehem Steel Corporation stock certificate 1927 (famous bankruptcy)

Awesome financial collectible. Great vignette of a classical male figure seated in front of steel mill and waterfront scenes. Issued and cancelled. Dated 1927.

Bethlehem Steel Corporation was America's second-largest steel producer and largest shipbuilder. Bethlehem Steel and a subsidiary company, Bethlehem Shipbuilding Corporation, were two of the most powerful symbols of American industrial manufacturing leadership. Their demise is often cited as one of the most prominent examples of the U.S. economy's shift away from industrial manufacturing, its failure to compete with cheap foreign labor, and management's penchant for short-term profits. After a decline in the American steel industry and other problems leading to the company's bankruptcy in 2001, the company was dissolved and the remaining assets sold to International Steel Group in 2003. In 2005, ISG merged with Mittal Steel, ending American ownership of the assets of Bethlehem Steel.

he company's roots go back to 1857 when the Saucona Iron Company was first organized by Augustus Wolle. The Panic of 1857, a national financial crisis, halted further organization of the company and construction of the works. Eventually, the organization was completed, the site moved elsewhere in South Bethlehem, and the company's name was changed to the Bethlehem Rolling Mill and Iron Company. On June 14, 1860, the board of directors of the fledgling company elected Alfred Hunt president.

On May 1, 1861, the company's title was changed again, this time to the Bethlehem Iron Company. Construction of the first blast furnace began on July 1, 1861, and it went into operation on January 4, 1863. The first rolling mill was built between the spring of 1861 and the summer of 1863, with the first railroad rails being rolled on September 26. A machine shop, in 1865, and another blast furnace, in 1867, were completed. During its early years, the company produced rails for the rapidly expanding railroads and armor plating for the US Navy.

In 1899, the company assumed the name Bethlehem Steel Company. In 1904, Charles M. Schwab and Joseph Wharton formed the Bethlehem Steel Corporation with Schwab becoming its first president and chairman of its board of directors. In the early 1900s, the corporation branched out from steel, with iron mines in Cuba and shipyards around the country. In 1913, it acquired the Fore River Shipbuilding Company of Quincy, Massachusetts, thereby assuming the role of one of the world's major shipbuilders. In 1917, it incorporated its shipbuilding division as Bethlehem Shipbuilding Corporation, Limited. In 1922, it purchased the Lackawanna Steel Company, which included the Delaware, Lackawanna and Western Railroad as well as extensive coal holdings. Although the company continued to prosper during the early 1880s, its share of the rail market began to decline in the face of competition from growing Pittsburgh-based firms such as the Carnegie Steel Company.

The nation's decision to rebuild the United States Navy with steam-driven, steel-hulled warships reshaped Bethlehem Iron Company's destiny. In spring 1886, Congress passed a naval appropriations bill that authorized the construction of two armored second-class battleships, one protected cruiser, and one first-class torpedo boat, and the complete rebuilding and modernization of two Civil War-era monitors. The two second-class battleships (the USS Texas and the USS Maine) would have both large-caliber guns and heavy armor plating. Bethlehem secured both the forging and armor contracts on June 28, 1887.

Between 1888 and 1892, the Bethlehem Iron Company completed the first U.S. heavy-forging plant. It was designed by John Fritz with the assistance of Russell Wheeler Davenport, who had entered Bethlehem's employ in 1888. By autumn 1890, Bethlehem Iron was delivering gun forging to the U.S. Navy and was completing facilities to provide armor plating. During World War I and World War II, Bethlehem Steel was a major supplier of armor plate and ordnance to the U.S. armed forces, including armor plate and large-caliber guns for the Navy.

In the 1930s, the company made the steel sections and parts for the Golden Gate Bridge and built for Yacimientos Petrolíferos Fiscales (YPF), a new oil refinery in Argentina, which was the tenth-largest in the world. During World War II, as much as 70 percent of airplane cylinder forgings, one-quarter of the armor plate for warships, and one-third of the big cannon forgings for the U.S armed forces were turned out by Bethlehem Steel. Bethlehem Steel ranked seventh among United States corporations in the value of wartime production contracts. Bethlehem Shipbuilding Corporation's 15 shipyards produced a total of 1,121 ships, more than any other builder during the war and nearly one-fifth of the U.S. Navy's two-ocean fleet.

The U.S. advantage lasted about two decades, during which the U.S. steel industry operated with little foreign competition. But eventually, the foreign firms were rebuilt with modern techniques such as continuous casting, while profitable U.S. companies resisted modernization. Bethlehem experimented with continuous casting but never fully adopted the practice. Meanwhile, the average age of the Bethlehem workforce was increasing, and the ratio of retirees to workers was rising, meaning that the value created by each worker had to cover a greater portion of pension costs than before. Former top manager Eugene Grace had failed to adequately invest in the company's pension plans during the 1950s. When the company was at its peak, the pension payments that should have been made were not. As a result, the company encountered difficulty when it faced rising pension costs and diminishing profits.

By the 1970s, imported foreign steel was generally cheaper than domestically produced steel. The company faced growing competition from mini-mills, smaller-scale operations that could sell steel at lower prices. In 1982, Bethlehem reported a loss of US$1.5 billion and shut down many of its operations. Profitability returned briefly in 1988, but restructuring and shutdowns continued through the 1990s. In 1991, Bethlehem Steel discontinued coal mining. At the end of 1995, it closed steel-making at the main Bethlehem plant. After roughly 140 years of metal production at its Bethlehem, Pennsylvania, plant, Bethlehem Steel ceased operations in Bethlehem. Bethlehem Steel exited the railroad car business in 1993 and ceased shipbuilding activities in 1997 in an attempt to preserve its steel-making operations.

In 2001, Bethlehem Steel filed for bankruptcy. In 2003, the company's assets, including its six massive plants, were acquired by the International Steel Group.

Loading... Please wait...

Loading... Please wait...