Categories

Categories

- Home

- Mining and Oil

- Oil

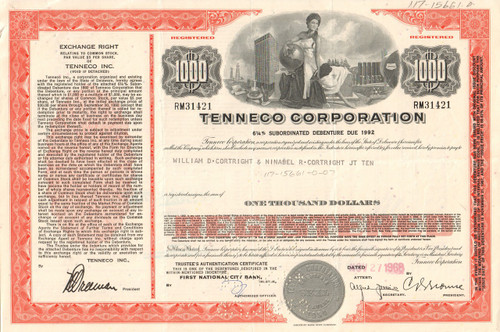

- Tenneco Corporation bond 1960-1970's (petroleum)

Tenneco Corporation bond 1960-1970's (petroleum)

Product Description

Tenneco Corporation bond certificate 1960-1970's (petroleum)

Great oil collectible. Beautiful vignette of a classical female figure in front of oil fields, city building, and an oil storage scene. Issued and cancelled. Dated 1960-1970's..

Tenneco, Inc.'s origin was in the Chicago Corporation, established about 1930. Tennessee Gas and Transmission Company had been formed in 1940. In the 1950s, the company acquired existing oil companies, including Sterling Oil, Del-Key Petroleum, and Bay Petroleum. The Tennessee division of the Chicago Corporation acquired Tennessee Gas Transmission Company in 1943 to build a natural-gas pipeline 1,265 miles from Texas to West Virginia. The first line was completed in October 1944. It was followed by three additional pipelines totaling 3,840 miles during the next 15 years which provide gas to New York and New Jersey.

In 1966, Tennessee Gas was incorporated as Tenneco, Inc. Tenneco expanded into a number of business ventures as a result of diversification. Tenneco bought Houston Oil & Minerals Corporation in the late 1970s. Tenneco owned and operated a large number of gasoline service stations, but all were closed or replaced with other brands by the mid-1990s.

In the 1970s, Tenneco purchased 53% of J.I. Case when they purchased its owner Kern County Land Company, the agricultural equipment manufacturer based in Racine, Wisconsin, USA. In 1972, Tenneco purchased UK-based David Brown Tractors Ltd. and merged it with the J.I. Case business. In 1984, Case parent Tenneco bought selected assets of the International Harvester agriculture division and merged it with J.I. Case. All agriculture products are first labeled Case International and later Case IH. Tenneco purchased the articulated 4WD manufacturer Steiger Tractor in 1986, and merged it into Case IH.

The corporate direction was to buy failing companies, and work to develop them into market leaders. This worked well with Newport News Shipbuilding, but failed miserably with the various tractor companies, probably due in large part to the economy at the time. By 1988, the company was losing $2 million per day. After being pressured by the banks, it was decided to sell off the oil business. Tenneco Oil Exploration Company was split up and sold off to multiple buyers.

By 1994, Tenneco decided to begin getting out of the ag business and agreed to sell 35% of the now named Case Corporation. In 1996, the spin-off of Case Corporation was completed. The company was acquired by Fiat in 1999 and merged with New Holland Agriculture to form CNH Global.

Tenneco Inc. emerged from a conglomerate consisting of six unrelated businesses: shipbuilding, packaging, farm and construction equipment, gas transmission, automotive, and chemicals. The automotive division was spun off from Tenneco, Inc. in 1991 along with the packaging, energy, natural gas, and shipbuilding divisions. All businesses except automotive and packaging were disposed of between 1994 and 1996. In 1999, Tenneco Packaging was spun off and renamed to Packaging Corporation of America (Pactiv Corporation).

Since the 1960s Tenneco Automotive sold mufflers in Europe, including through the chain "Pit Stop" in Germany. The group bought a German factory in Virnheim in 1969, Swedish Starla in 1974 and French Bellanger and English Harmo Industries in 1976 and Danish Lydex in 1978. More acquisitions followed. On October 28, 2005 the name was changed from Tenneco Automotive to Tenneco.

Loading... Please wait...

Loading... Please wait...